September is over! We're already starting the last quarter of 2023. September was not so nice in terms of stock price development . I had some big losers in the REIT-sector (especially MPW with -25%) but generally a broad decrease in my portfolio. Biggest winners were Shell and Exxon (+4 to +5%), probably because of rising oil prices.

Let's see how many companies sent me a dividend check for my ownership. These checks are the results of decisions I made earlier in life, sometimes years ago, where I decided to purchase shares in these companies. Nowaydays I still collect these checks but I have to do absolutely nothing to receive them. They just get deposited in my brokerage account, no questions asked. Isn't that great?!

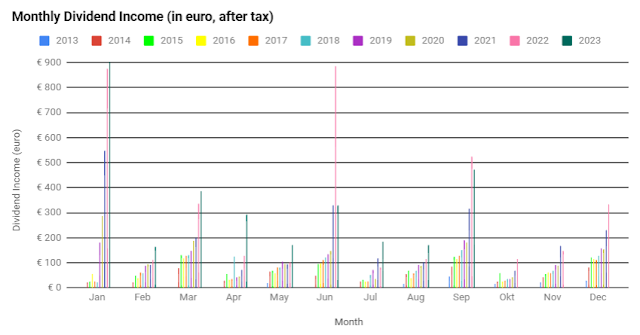

A total of just over €470 after tax. 16 companies paid me dividends. The dividend income decreased by about 10% compared to last year including the FX-effect. This decrease has a few reasons:

- Dividend cuts from Intel and BHP.

- Closed positions in BIP and BEP.

Without these events my "regular" dividend income grew nicely. This is mainly the result of additional purchases in Ahold (here), TROW (here), Aflac (here) UNP (here and more recently here) and O (here, and an additional purchase last month which I did not publish). Throw in some nice dividend increases from Shell and some smaller raises from other companies and this is the result.

So all in all a decent month!

In the graph above I've showed my monthly dividend income. You can see last year's high dividend payments (in June as well) but the underlying trend is still up.

How was your September? What is your watchlist for the next month?

No comments:

Post a Comment