Most if not all the Dividend Growth Investors on Seeking Alpha have used the so called CCC-list, maintained by David Fish. On this list are companies which have increased their dividend payout for at least 5 years (challengers), 10 years (contenders) or 25+ years (champions). Even though these companies are American based, a lot of these companies on this list have global exposure. However, in any case, they are still listed on American stock exchanges, valued in American dollars and also pay regular dividends in American dollars. For someone based in other areas of the world (in this case Europe), this poses a risk due to changes in the EUR.USD-rate.

As a DGI I would like to diversify my dividend income stream between companies listed in Europe and the USA. Of course the most important thing is that I want to invest in great companies with solid business fundamentals, good history of earnings and dividends and shareholder friendly management. Acomo is certainly one of them!

Acomo

Amsterdam Commodities N.V. (Acomo) is an international group of companies with its principal business the trade and distribution of agricultural products. Acomo is a decentralized company with the following main trading subsidiaries:

Their business is divided in four segments. Spices, nuts and dried fruits is the most important in terms of revenue and net income, food ingredients the least. Tea and seeds both account for roughly a quarter of total sales. Net margin for all the segments combined is just under 5%.

* In million euro

Sales are geographically diversified where the European Union (not all of Europe!) accounts for the highest share (36%).

Revenue and profitability development (2004-2013)

In 2004 Acomo's revenue stood at 117 million euro. In 9 years (and during a big recession), Acomo increased sales by 20% on a yearly basis (compounded annual growth rate, or CAGR). Net income followed suit and increased from 5.5 million euro to over 27 million (CAGR of 19%). Especially between 2009-2012 Acomo successfully integrated new trading subsidiaries (Red River, Van Rees en King Nuts). During this period Acomo has never posted a loss.

Dividend

According to the CEO, Erik Rietkerk, Acomo has always valued long-term reliability, robust financial policies and healthy dividends for their shareholders. This motto is also stated in their mission "… to achieve long-term sustainable growth of shareholders' value through consistent growth of earning per share, allowing for continued high dividend pay-outs representing above-market dividend returns".Beautiful words, but how has Acomo performed in recent years?

Acomo currently yields around 4.5%, divided into two semi-annual installments: one smaller interim payment in September and one bigger final payment in May. Even though I'd prefer equal, quarterly dividend payments, it's better than most European companies which only pay dividends once per year.

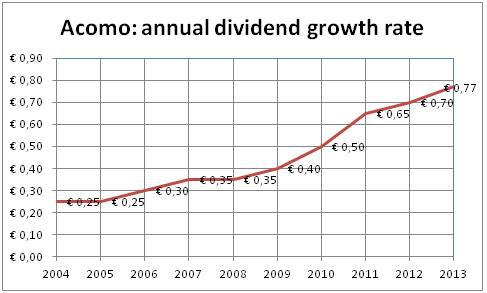

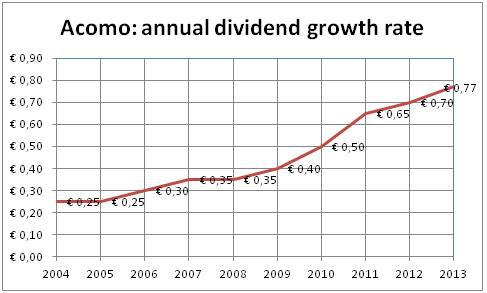

Back in 2004, Acomo paid 0.25 euro per share in dividends, in 2013 that has increase to 0.77 euro per share, a compounded annual growth rate of more than 13%. This company definitely passes the Chowder-rule (current yield + 5/10yr DGR > 12%).

However, is the great yield AND dividend growth sustainable? For this we'll look into the pay-out ratio. In 2013, Acomo earned 27 million in net income. It paid out 65% of these profits in dividends. This pay-out ratio has been relatively constant in recent years. But it does show that for the dividend growth rate to continue in future years, revenue needs to increase.

Balance sheet

The balance sheet looks fine. Acomo carries a total debt of 76 million euro. Shareholders' equity is almost 131 million, so the debt/equity-ratio is 0.58. I prefer this ratio to be smaller than 1, so this is just fine. The interest coverage-ratio is also great at 11x. This means that the current net profit covers the interest payment 11 times over!

Foreign exchange positions

All operating companies are required to hedge foreign exchange risks related to transactions against their functional currency. In most cases this will be the euro currency, however Red River Commodities and Van Rees Group use the US dollar as their functional currency. Future development of the USD.EUR-rate can have a positive or negative impact on the consolidated results, reported in euro.

Outlook

Acomo has identified two ways to grow: autonomous or by acquisitions. Autonomous growth comes from diversifying products, channels or do "bolt-on"-acquisitions to amplify current operations and results. It means cross selling of products and services where possible and using existing knowledge and performance in other niche products.

Acquisition growth must support Acomo's goals and according to management needs to be 'the right opportunity at the right price at the right time'. No growth for the sake of size only. As a potential shareholder this is music to my ears. Even though Acomo has proven to be able to integrate new groups in their holding successfully, nothing fears me more as management (in general, not Acomo's) sitting on a pile of cash pondering megalomaniac take-overs.

Valuation

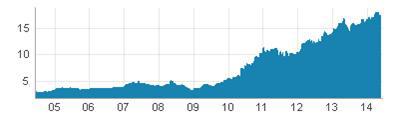

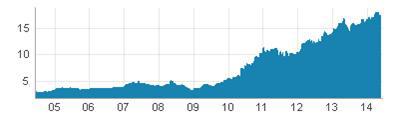

With the current share price at 17 euro, Acomo sports a P/E-ratio of around 14.5. Compared to the overall market this might seem reasonable, however compared to previous years it's somewhat high. The P/E-ratio was in the range of 7-9x between 2004-2009. After 2009 the P/E-ratio expanded. This is also the case when looking at historic yields. Current yield of 4.5% is historically low, compared to yields of 6-10% in recent years. During the Great Recession, the stock price marched onwards, never looking back.

However, a company yielding 4.5% and growing dividends with 13% per year, a P/E-ratio of 14.5 seems like a fine deal. But the constant increase in stock price in the last few years does scare me a bit: are we due for a correction?

Summary

Acomo seems like a great company. It has grown consistently and has proven to be able to absorb large acquisitions. They have shareholder friendly dividend policies and maintain robust financial planning. The markets they work in are here to stay. With increasing global population, development of populous areas (like India, China and Brazil), and increased health concerns about food, Acomo is ready for the future. However, the market seems to agree. The stock price increased drastically in recent years. For now this causes me to stop and wait for a pullback of the stock price in the coming months. If I see a drop towards 14-15 euro (or minus 12-18%), I'll definitely take another quick look and then pounce!

As a DGI I would like to diversify my dividend income stream between companies listed in Europe and the USA. Of course the most important thing is that I want to invest in great companies with solid business fundamentals, good history of earnings and dividends and shareholder friendly management. Acomo is certainly one of them!

Acomo

Amsterdam Commodities N.V. (Acomo) is an international group of companies with its principal business the trade and distribution of agricultural products. Acomo is a decentralized company with the following main trading subsidiaries:

- Catz International B.V. in Rotterdam (spices nuts and dried fruits)

- Van Rees Group B.V. in Rotterdam (TEA)

- Red River Commodities Inc. in Fargo North Dakota USA (confectionary seeds)

- TEFCO Euro Ingredients B.V. in Bodegraven (food ingredients)

- Snick Euro Ingredients N.V. in Beernem BE (natural food ingredients)

- KingNuts & Raaphorst B.V. in Bodegraven (nuts & rice crackers).

Their business is divided in four segments. Spices, nuts and dried fruits is the most important in terms of revenue and net income, food ingredients the least. Tea and seeds both account for roughly a quarter of total sales. Net margin for all the segments combined is just under 5%.

Segment | Revenue | Income | Net margin |

|---|---|---|---|

| Food ingredients | 20.5 | 1.3 | 6.3% |

| Spices, nuts & dried fruits | 262.8 | 14.9 | 5.7% |

| Tea | 148.3 | 3.6 | 2.4% |

| Seeds | 156.2 | 8.9 | 5.7% |

| Holdings & intra group | -3.4 | -1.3 | - |

| Total | 584 | 27.4 | 4,7% |

Sales are geographically diversified where the European Union (not all of Europe!) accounts for the highest share (36%).

Revenue and profitability development (2004-2013)

In 2004 Acomo's revenue stood at 117 million euro. In 9 years (and during a big recession), Acomo increased sales by 20% on a yearly basis (compounded annual growth rate, or CAGR). Net income followed suit and increased from 5.5 million euro to over 27 million (CAGR of 19%). Especially between 2009-2012 Acomo successfully integrated new trading subsidiaries (Red River, Van Rees en King Nuts). During this period Acomo has never posted a loss.

Dividend

According to the CEO, Erik Rietkerk, Acomo has always valued long-term reliability, robust financial policies and healthy dividends for their shareholders. This motto is also stated in their mission "… to achieve long-term sustainable growth of shareholders' value through consistent growth of earning per share, allowing for continued high dividend pay-outs representing above-market dividend returns".Beautiful words, but how has Acomo performed in recent years?

Acomo currently yields around 4.5%, divided into two semi-annual installments: one smaller interim payment in September and one bigger final payment in May. Even though I'd prefer equal, quarterly dividend payments, it's better than most European companies which only pay dividends once per year.

Back in 2004, Acomo paid 0.25 euro per share in dividends, in 2013 that has increase to 0.77 euro per share, a compounded annual growth rate of more than 13%. This company definitely passes the Chowder-rule (current yield + 5/10yr DGR > 12%).

However, is the great yield AND dividend growth sustainable? For this we'll look into the pay-out ratio. In 2013, Acomo earned 27 million in net income. It paid out 65% of these profits in dividends. This pay-out ratio has been relatively constant in recent years. But it does show that for the dividend growth rate to continue in future years, revenue needs to increase.

Balance sheet

The balance sheet looks fine. Acomo carries a total debt of 76 million euro. Shareholders' equity is almost 131 million, so the debt/equity-ratio is 0.58. I prefer this ratio to be smaller than 1, so this is just fine. The interest coverage-ratio is also great at 11x. This means that the current net profit covers the interest payment 11 times over!

Foreign exchange positions

All operating companies are required to hedge foreign exchange risks related to transactions against their functional currency. In most cases this will be the euro currency, however Red River Commodities and Van Rees Group use the US dollar as their functional currency. Future development of the USD.EUR-rate can have a positive or negative impact on the consolidated results, reported in euro.

Outlook

Acomo has identified two ways to grow: autonomous or by acquisitions. Autonomous growth comes from diversifying products, channels or do "bolt-on"-acquisitions to amplify current operations and results. It means cross selling of products and services where possible and using existing knowledge and performance in other niche products.

Acquisition growth must support Acomo's goals and according to management needs to be 'the right opportunity at the right price at the right time'. No growth for the sake of size only. As a potential shareholder this is music to my ears. Even though Acomo has proven to be able to integrate new groups in their holding successfully, nothing fears me more as management (in general, not Acomo's) sitting on a pile of cash pondering megalomaniac take-overs.

Valuation

With the current share price at 17 euro, Acomo sports a P/E-ratio of around 14.5. Compared to the overall market this might seem reasonable, however compared to previous years it's somewhat high. The P/E-ratio was in the range of 7-9x between 2004-2009. After 2009 the P/E-ratio expanded. This is also the case when looking at historic yields. Current yield of 4.5% is historically low, compared to yields of 6-10% in recent years. During the Great Recession, the stock price marched onwards, never looking back.

However, a company yielding 4.5% and growing dividends with 13% per year, a P/E-ratio of 14.5 seems like a fine deal. But the constant increase in stock price in the last few years does scare me a bit: are we due for a correction?

Summary

Acomo seems like a great company. It has grown consistently and has proven to be able to absorb large acquisitions. They have shareholder friendly dividend policies and maintain robust financial planning. The markets they work in are here to stay. With increasing global population, development of populous areas (like India, China and Brazil), and increased health concerns about food, Acomo is ready for the future. However, the market seems to agree. The stock price increased drastically in recent years. For now this causes me to stop and wait for a pullback of the stock price in the coming months. If I see a drop towards 14-15 euro (or minus 12-18%), I'll definitely take another quick look and then pounce!

I'm a happy owner of Acomo for about three years now! Great company and has some moat.

ReplyDeleteHiya Robert, thanks for stopping by and taking the time to comment. You've done great in the last 3 years as a shareholder, right? What do you think of the current valuation?

DeleteHi Robin,

ReplyDeleteThanks for the write up. I have been searching for interesting EUR investments for a while. I'll make sure to keep ACOMO on my watch list.

Best,

DW

Hi D&W, no problem! Of course I am interested in your opinion on this or other EUR dividend paying companies.

DeleteHey Robin!

ReplyDeleteThanks for bringing this company to my attention. I have been looking from some European dividend growth stocks as well, but there aren't actually that many of them. It's always hard to buy stocks that are trading at so much higher level than usually, but are you buying cash flow from dividends or are you speculating with price? If you forget the historical valuation for a second, I think this stock looks very attractive. High yield, fast growth and low PE! I'll definitely be monitoring this company.

PS. I just found your blog, looks good! It's nice to hear about other than American companies as well.

Regards,

TDW

Thank you for this blog. That's all I can say. You most definitely have made this blog into something thats eye opening and important. You clearly know so much about the subject, you've covered so many bases. Great stuff from this part of the internet. Again, thank you for this blog.

ReplyDeletelong grain white rice